This article is an opinion piece and is solely the authors views mixed with a little bit of external data and any of the following should be taken as personal opinion.

Broadcom seeking to acquire VMware – too big to fail. Update – Broadcom acquires VMware!

Update: I have written about the next 12 months for VMware here, based on personal experience from the previous Broadcom Acquisition of a good revenue stream company with poor profitability.

The news this week is that Broadcom is looking to acquire Vmware, this is certainly newsworthy for a couple of reasons, one is that VMware is a very large software company, the other is that Broadcom is a “strip out value for profit” business, what I mean by this is that any acquisition becomes a skeleton of its former glory, but this is not necessarily bad for all, except the staff, customers, and business partners of the old VMware business – Seriously this acquisition will destroy VMware and I am taking bets on how long, 6 or 12 months anyone?.

Introduction

In life there are winners and losers and for every positive there is a negative or so it is said by people much wiser than I – this is not starting from a very high baseline either if I am considering my personal wisdom.

When looking at the winners and losers to be, with the proposed acquisition of VMware by Broadcom there are a few to be called out:

| Winners | Losers |

| Broadcom Executives | Vmware customers |

| Competitors | Vmware distributors |

| Broadcom Shareholders (or possibly not) | Vmware Staff |

| The tech industry |

When Harry met Sally (Broadcom conquers Symantec)

In our recent past (the world before Covid), Broadcom acquired Symantec, this was November 2019 and the price tag was $10.7 billion US Dollars, at that time one of the largest cyber security tech acquisitions.

There was no time to waste post acquisition and there was no planning of what was needed and what was disposable. The first 30 days post acquisition was a literal (ok, figurative) blood bath of Symantec staff and admin staff being retrenched with little to no support, most of these teams being immediately made redundant due to duplication on the Broadcom/CA side of the business and even where there was not duplication people were let go. For example the lifeblood of a sales business is sales people, well over 90% of them were retrenched.

Now on to the negative side of running a business post acquisition:

Sales were not able to be processed at all for some time post take over, due to the laser focus on not sharing services with the freshly spun off Norton Security business, a decision was made to detach the sales platform and start anew. No forward planning here and no care for customers of Symantec.

Also little consideration was taken for aspects like ongoing subscriptions, buying licenses, renewing licenses, partners, distribution or anything other than not spending money continuing to use the Norton platform, this decision will come back to bite the sales operations function multiple times in the following 12 months when decisions to End of Life, change licensing etc would have none of the necessary “plumbing” configured underneath to keep the lights on, again with the sole focus of saving $$$.

Infact any decision made at the top would be carried out with any consideration for the fallout from the business or customers, there is no alternative to the decision being made by the executive team.

Small to mid sized partners and customers were unable to buy licenses for many more months until February 2020, not an ideal process for customers wanting to renew or buy licenses.

Considering the go forward strategy by the acquiring company to not maintain small to mid sized businesses this worked in their favour by turning partners and customers away early on.

Next change was the changing of most distributors from those who knew the products and the market to new distributors, except for Ingram, who fired Broadcom as their distributor before Broadcom could sign them up.

All of this led to a previous business run by Symantec who was delivering approximately $2-2.2 billion USD returning $1.5 billion to Broadcom post acquisition, not a great result except that the profitability obtained after reducing staff by 80% was looking very good.

The net result is good for profitability but negative for a couple of reasons, one the revenues dropped by $700 million – significant and as to be expected when a company treats customers and business partners poorly, and the $10.7 billion spent which will not be made back through sales in the next 5-7 years if Broadcom was to be paying their debt off using the software acquisitions as a pivot away from hardware.

Apparently though Broadcom are a bully in the hardware business too, bad for a business who happened to use Broadcom hardware and software due to the way they lock customers into their model.

Antitrust: Commission accepts commitments by Broadcom (europa.eu)

The market loves Broadcom though as they are one of the minority of tech companies that actually make money from selling stuff, rather than hype and their share price has more than made up for the difference so overall a net benefit to the shareholders through the magic of the stock market when looking for tech companies to invest in regardless of profitability from their purchases, ahem Crowd-strike.

Regrowth and Rejuvenation

The acquisition of Symantec was very good for the rest of the cyber security market, take this quote for example:

“I am picking up on disturbing news about Symantec. First a reseller from Colombia that I was chatting with at the recent RSA Conference in San Francisco informed me that he was there to find a solution to fill a gap created by Symantec abandoning all but its top resellers. Second, another industry veteran told me that Symantec is abandoning all but its most profitable 2,000 customers. That will leave over 100,000 Symantec customers looking for alternatives. It’s a good time to be CrowdStrike, Blackberry Cylance, or Carbon Black.”

Forbes – Richard Stiennon

https://www.forbes.com/sites/richardstiennon/2020/03/16/the-demise-of-symantec/?sh=d533b4c5fc7d

Top 2000 customers was incorrect, the actual number is less than 500 globally.

It came to be that the loss of a huge cyber security company such as Symantec was very good for the remaining vendors, just like a bush fire after the initial death and destruction new growth comes through the burnt and black charred earth, but it is hard to see how this will happen with VMware, most of the dollars spent will go directly to Microsoft as the major competitor in this space.

Customers were leaving in the droves as they could not acquire licenses and could not get support for the products they purchased due to the acquiring company shutting down support without training up a replacement, another decision made without consideration of the customer who is supposed to always be right, Right?

The one constant for Broadcom employees is the habit of always looking over your shoulder waiting for the email to come, requesting a meeting with your manager and the HR manager saying “It’s not us, it’s you, we just don’t have enough work for you to do”, when you are already performing the function of two previous employees let go in prior months.

The layoff has a lot of comments on the rocky road that employees face under Broadcom, great salary but do not expect any one to care about your requirements.

History tends to repeat itself

History has a habit of repeating itself, in this case CA came and fell before Symantec and arguably a basket case with legacy product selling into large enterprise like banks and large government organisations, but having lost relevance across the rest of the market.

Being ‘sexy’ is not all that sells and Broadcom could see this, having products that can not be easily be replaced are a great business to be in as just like ransomware, the prices can be increased each year by 10-20% and there is nothing that can be done to change this when the company “selling you software” has you ‘secured’ with no alternative solutions.

In the case of the CA acquisition at a cost of $18.9 billion in cash, Broadcom were not acquiring technology they were acquiring enterprise customers who could not afford to move their platform away from CA products.

Effective legal ransomware because the CA products were so sticky and entrenched with no viable alternatives as the software companies had moved on to newer technologies and promises.

Unfortunately VMware is not too big to fail and if the acquisition is completed then the industry will find that history does repeat unless the lessons learnt prior are remembered.

Numbers tell a story

The Net benefit of Broadcom’s major acquisitions of Symantec and CA can be measured relative to the rest of the industry and it is not pretty, where the rest of the software industry is growing through innovation and the demands that have occurred through the past couple of covid years, Broadcom software has basically stood still, or kept pace with inflation, hardly a shining example of moving into software to diversify their portfolio, the reality is more likely to secure their 500 customers by being more sticky.

When a company removes 90% of their sales capability it proves through actions what the intent is. Just as I tell my children, it is not the words or marketing, it is the actions that prove intention.

Broadcom revenues moved at a miserly 5% for enterprise software including the CA business at $1.8 billion USD, less than the revenues from Symantec’s business (2019) alone, in the 2021-22 financial year.

Where as the rest of the software market grew at rates far in excess of 5%, for example non cyber security software and hardware is expected to continue to grow at 11% between 2022-30, this business being the equivalent of the CA ransomware business.

https://www.grandviewresearch.com/industry-analysis/business-software-services-market

And even better, Cyber security software is expected to continue to grow at 13.4% between 2022-30, the equivalent of the Symantec business, Broadcom’s business model has left it way behind the market.

Summary: Broadcom is growing at 5-6% across their software business, well behind the market and when factoring in the 20% uplift required of enterprise customers shows a story that clients are leaving Broadcoms software business at a fast pace and those that are left behind are paying too much for their licenses.

For the shareholders

Of course revenue growth is not the whole story and profitability is the core of the Broadcom strategy, and at this they are hugely successful. So the shareholders win in this scenario, which is the ultimate goal of any public company.

What the shareholders do not see, is that sustained growth from software is not occurring within the Broadcom business, it is a sinking lid policy of acquiring more revenues from fewer customers.

The Broadcom model is to make big business pay more for what they use and ratchet-up the license costs with no relief possible.

Schoolyard bully?

Broadcom as an organisation would be considered a bully if it was found in the schoolyard, Broadcom is the gigantuan monster kid asking for everyones lunch money and taking by force what is not given freely.

The primary strategy for all large Broadcom clients was for a 10-20% uplift per year without exception, because it is 30% of customers that return 80% of the profit – smaller sales cost more money per dollar earned, which is no great surprise. This will also be true for VMware clients if the acquisition proceeds.

Broadcom’s practise is for Enterprise licenses to be sold wherever possible with no way of reducing spend at the end of the term, in fact if a customer is to try and reduce their Enterprise license back to individual products then they will be charged the same amount as the previous EAL for the remaining licenses. If this is not a ransomware operation then I do not know what is.

The Broadcom story is a Tale of two opposing forces, growth or profitability. In a Bear market as we are facing today profitability wins out over “growth regardless of cost” as many other enterprise businesses but at what cost to the rest of the industry?

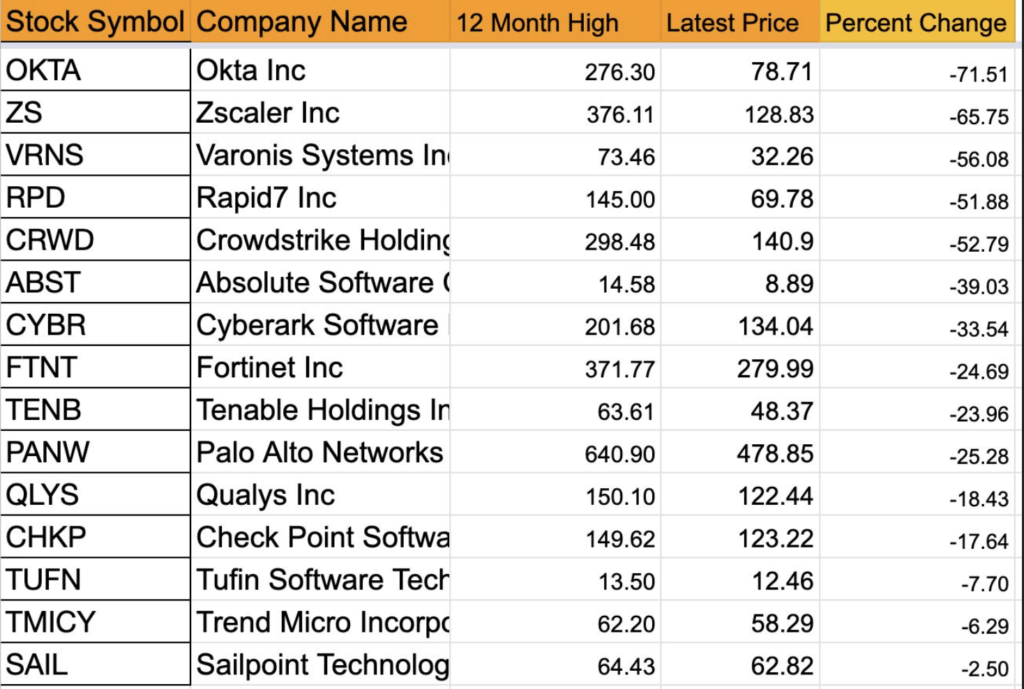

Source: https://thansyn.com/is-cybersecurity-recession-proof/

In the above chart, some of the businesses make money and some cost money to operate, this is the other side of the Profit vs growth coin, growth at all costs is also not sustainable or wise, there needs to be a happy medium but this can not happen in a market driven by hype, human greed and hysteria over being first to buy into the next big thing.

And maybe this is where Broadcom makes sense, Broadcom has no employee ethics, no customer ethics but it does make money hand over fist, where as many other software companies are out there doing deals to gain market share and promising their employees and shareholders the world, but underneath there is no substance?

Back to VMware

The affect that a Broadcom acquisition of VMware has on the rest of the software industry will be a realignment at extreme cost and effort for the customers and business partners of VMware products – this is not Hyperbole.

The winners will be VMwares competition and that ecosystem will flourish, I have written about acquisition before here.

But the cost to business in monetary value as well as the good will that is lost each time a customer has to go through these changes is irreparable and push businesses towards the safe bets like Microsoft – in fact it is only Microsoft, AWS and Google who are truly to big to fail if this acquisition proceeds.

The cost to VMwares human capital, the people who make the business work so well will also be lost, to resurface in other organisations keeping the circle of life going.

In conclusion

Update: The acquisition is confirmed as proceeding God help the customers of VMware who are not in the top 500 and the employees of VMware, leave now if you wish to have control. Broadcom has no soul, sort of like the devil where the benefits can be good if you are left behind but it is going to be HOT!

In conclusion there are a few key takeaways from all of this and unfortunately that is for purchasers of enterprise software to always plan forward with a strategy for any eventual acquisition, meaning make sure you do not purchase and customise any software product to the point where you can not migrate away to another solution. Do not get stuck with a product that development stops for either as you will become trapped into extreme costs to keep business operating.

If you are an employee of Vmware and the acquisition by Broadcom is confirmed then it is time to leave and find a new role, there is no employee in Broadcom that will not be replaced/reduced – except for Hock Tan, though if this happens then Broadcom may become a more human capital friendly business.

These lessons also point towards buying into platforms such as Microsoft and not small vendors unless you must do it for customisation reasons etc, because the proposed purchase of Vmware demonstrates that even a massive company can be acquired and stripped of its value to bring profit to investors.

Investing your human capital and money into small vendors or vendors who still are not profitable is a dangerous move as the investment made may not be returned if the vendor is acquired and at the very least your pricing will increase by 20% or more at your next renewal.

My hope is that Michael Dell vetos this merger, from my accounts of Michael and the people I know who are employed by Dell, Michael is a great leader and a good human being and that is the most important thing, not profit at any cost.

And do not take my word for what is going to happen, read this much more succinct article on LinkedIn here that breaks the acquisition and Hock Tans statements down into an easy to digest format that leaves no room for discussion about what is about to happen on day 1 of the acquisition.

Ignore what VMware’s leader has stated, VMware has no choice in what happens, having been there through the same Symantec Management communications.

If you would like further insights that we can not share here then please contact us here.

Leave a Reply

You must be logged in to post a comment.